How does Nexus measure business start and what is a business start impact?

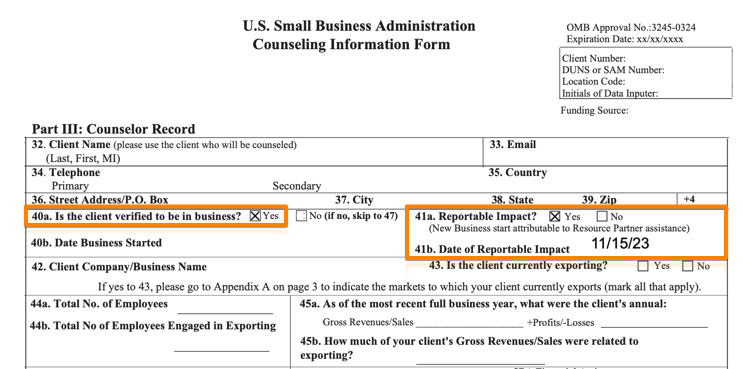

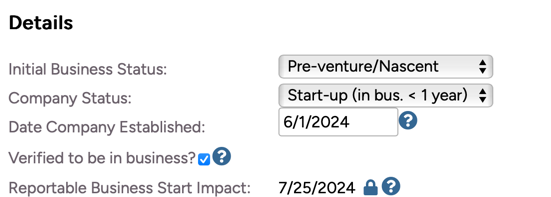

The SBA Nexus system measures business starts based upon the total number of clients with a Reportable Business Start Impact Date within the reporting period. The "Reportable Business Start Impact" field is a new field introduced on October 1, 2023 on the SBA 641 along with the "Verified to be in business" field:

Traditionally, a client tracks the date that their business was established based upon the date they obtained their business license. And this is tracked in Neoserra as the Business Established Date on the client record. However, SBA wants to know if the client is truly operational or not, as such, the counselor is asked the verify that the client really operating their business. The counselor can verify that the client meets the requirements for an in-business client as per the following SBA definition:

- Counselor must verify that the business completed required registration(s), if applicable, with the local, state, and/or Federal government (e.g., DBA registration, get a business license, agency issued tax identifications, etc.) AND at least one of the following:

- Generated Revenue Has documented a transaction from the sale of a product or professional or personal service for the purpose of gain or profit.

- Accessing Capital Has acquired debt or Equity Infusion to pursue business operations, for example, to purchase inventory, equipment, building, business, etc.

- Debt includes SBA Loans and Non-SBA loans. Non-SBA loans includes all forms of capital debt, for example, consumer debt products used specifically for the business, lines of credit, and other revolving debt facilities/instruments.

- Equity Infusion includes all forms of investments from all sources, for example, angel investors, crowd funding, family contributions, owners? capital contributions, grants and other capital contributions not associated with equity.

- Acquired Resources Has hired and/or compensated an employee(s) including the business owner/sole proprietor or contracted with an independent contractor(s) to perform essential business functions.

- Incurred Expenses Has incurred business expenses in the operation of a business.

In this FAQ, we will discuss how to update the Reportable Business Start Impact date for your clients and how to manage this date:

- Editing the client record

- Updating using the prompts

- Creating automatic update session

- Locking Reportable Business Start Impact Date

- Employee Owned

If you are curious as to what constitute a business start, please refer to this FAQ.

Editing the client record

Because only the counselor can verify whether the client is in business, or not, this field is not asked on eCenter Direct as part of the client intake process. Both the "Verified to be in business" and the "Reportable Business Start Impact" fields are only available in Neoserra and must be completed by the counselor.

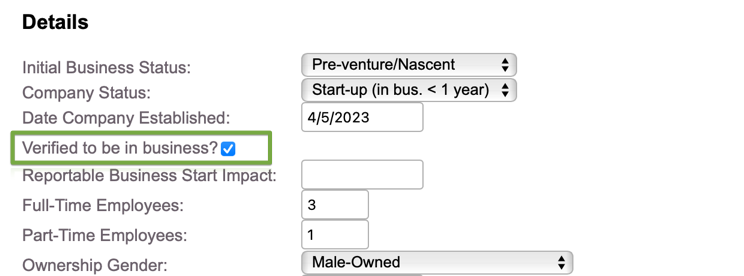

Once the counselor verifies that the client is in business based upon the criteria above, then the counselor will need to check the: "Verified to be in business?" checkbox on the client record:

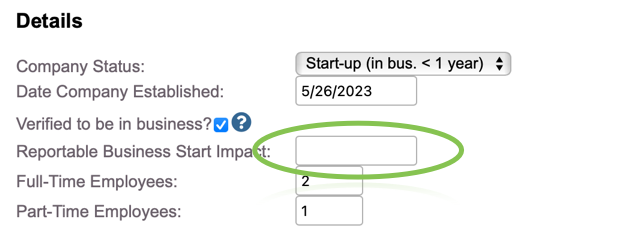

As soon as the client is verified to be in business by the business counselor then the "Reportable Business Start Impact" field becomes available for editing:

If the counselor substantively assisted that business in starting their operations, then the counselor can claim the business start impact, even if the date of such impact is long after the client's business established date. When the Reportable Impact date has been entered, it will be counted as a new business start in Nexus. The New Business Start will be counted within the Fiscal Year and Quarter of the session in which the Reportable Impact was reported.

No date prior to 10/1/XX is allowed to be entered, where XX represents the current fiscal year; nor can you enter a date into the future. Once the Reportable Impact has been claimed for a client, and once that information has been exported to Nexus, then the date is locked and no further subsequent business start impact may be claimed for that client. Administrators can edit locked records assuming the record is in the current fiscal year. The date that the edit is made to the client record will also be the date of the Business Start Impact milestone, which is automatically created when you update this field, along with the "Impact" session (see below for more information about the Impact session).

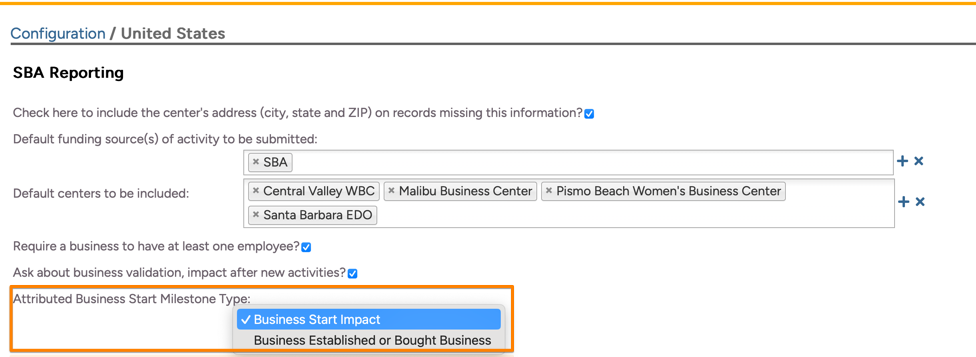

You may elect to track attribution either on the Established Date of the company or the Reportable Business Start Impact Date as determined on the Administration|Configuration|United States SBA page:

Updating using the prompts

Neoserra will offer a variety of prompts, any time you create a counseling, milestone or capital funding session with a client whose "Company Status" on the client record is set either to Start-up or In-business and whose business either has not yet been verified and/or where no impact has been recorded:

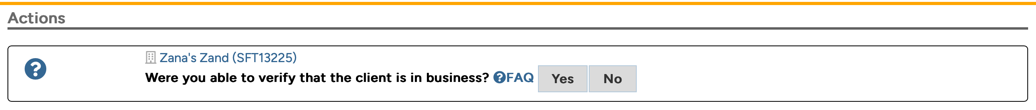

- If a client has a date established in their client record that is less than one year ago, and the "Verified to be in business" field is not checked, then Neoserra will offer the following prompt, after creating a session:

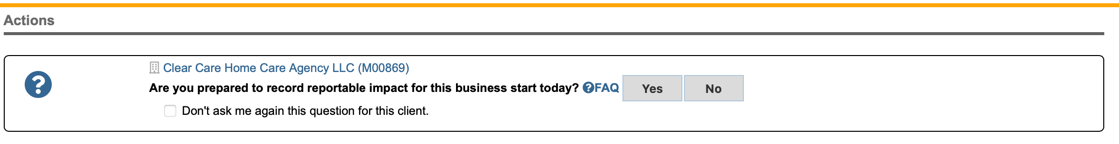

- If a client has a date established in their client record that is less than one year ago, and the "Verified to be in business" field is checked, then Neoserra will offer the following prompt, after creating a session:

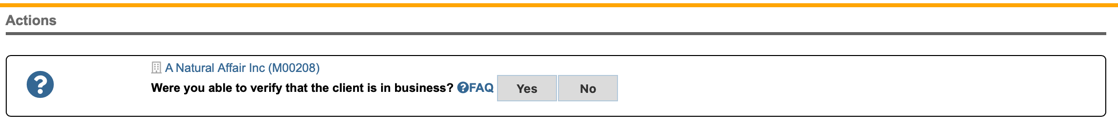

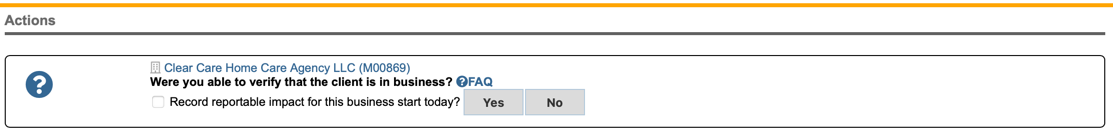

- If a client has a date established in their client record that is more than one year ago, and the "Verified to be in business" field is not checked, then Neoserra will offer the following prompt, after creating a session:

Clicking "Yes" only at this prompt, will cause Neoserra to check the "Verified to be in business" checkbox on the client record. If you click "Yes" and you check the little box next to: "Record reportable impact for this business today?" will also cause Neoserra to set the Reportable Business Start Impact Date to today on the client record.

Again, if you click "Yes" to record reportable impact for the client, then today's date will be put in the Business Start Impact Date field, and a Business Start Impact milestone will be automatically created. If you don't want to claim reportable impact today, nor do you anticipate claiming reportable impact in the future, then you can check the: "Don't ask me again this question for this client" then no reportable business impact will be claimed and this question will never pop-up again. If you simply select "No" then the same question will be asked the next time you meet with a client. checkbox. If you don't want Neoserra to ask you this question again, then it will be your responsibility to remember to set the Reportable Business Start Impact if/when you have substantively provided assistance to the client. The setting only applies to your user login, other users in your network will still see the prompt unless they also check the "Don't ask me..." box.

The bottom line, Neoserra will ONLY prompt to record Business Start Impact if the business formation was less than 1 year ago from the counseling session. Neoserra will continue to ask the counselor to verify that the client is in business regardless of when they started their business. Answering "Yes" to this question will check the "Verified to be in business" checkbox on the client record but no milestones will be created.

If the prompts are not desirable, then they can be suppressed on the United States SBA/DoD panel under the Administration|Configuration menu.

Creating automatic update session

As noted earlier, as soon as a date is entered in the Reportable Business Start Impact field, Neoserra automatically creates a corresponding "Business Start Impact" milestone, but another session is also created. This other session is a special "Impact" session that Neoserra will use to notify Nexus of the new Reportable Business Start Impact date.

The way that the Nexus XML is structured, the Reportable Business Start Impact Date is not part of the client record, but rather is uploaded to Nexus as part of the counseling session record. Thus, Neoserra needs to create a special counseling session in which this information is conveyed to Nexus:

This is a special counseling session, it cannot be edited or deleted by non-admin users. If you made an error with respect to the Business Start Impact Date, then the Reportable Business Start Impact date on the client record can be edited and updated.

The Impact session will be automatically created with a center that matches the home center of the user editing the client record. Futhermore, the Impact session will be created with a funding source that matches the funding source of the user editing the client record, assuming their funding source is locked on their user account record. If the user entering the Reportable Business Start Impact works for multiple grants and their funding source is not locked because they use different funding sources, then Neoserra will look at the "Assign user account funding source in preference to client default?" field on the Administration|Configuration|General Settings page to determine whether your program usually uses the client's funding source of the user's funding source, and Neoserra will assign the funding source accordingly. If for some reason no funding source has been assigned to the client record or the user record, then Neoserra will use the default as set on the Pick List page.

Administrators can edit this session, but they can only change the counselor selection, the center selection and the funding source. No other fields can be edited. To change or delete the Reportable Business Start Impact, the administrator can edit the client record and either update the Reportable Business Start Impact date or delete it. Editing the field on the client record automatically updates the Impact session.

Locking Reportable Business Start Impact Date

Once a Reportable Business Start Impact date has been uploaded and accepted into Nexus, then a non-administrator user will see that the date is locked, and cannot be edited:

Assuming that you are looking to edit a Reportable Business Start Impact Date that falls in the current fiscal year, then a database administrator will be able to edit the date and either change the date or delete the date. The updated information will then be included in the next Nexus export. If you are making changes at the end of the fiscal year, after all your exports have been completed, then a change to the Reportable Business Start Impact Date will require one more export to Nexus.

Once the fiscal year has been closed (i.e. one month after September 30th) then no one will be able to edit the Reportable Business Start Impact for the prior year. Even administrators will not be able to edit dates in prior fiscal years. Furthermore, no new Reportable Business Start Impact Dates that are outside of the current fiscal year can be added to any client record. Again, even database administrators will not be able to add dates in prior years (with the one month end of year exception allowing for year-end cleanup). And remember, any last minute edits that you make in Neoserra to the prior fiscal year will require one more export to Nexus to ensure the same information is reflected there.

Neoserra is lenient in that it allows editing up to one month after the end of the fiscal year. However, once that date has been met, then no one (not even database administrators) will be able to add/delete Reportable Impact Dates in a prior fiscal years. And, if you continue to make changes to the prior fiscal year during the month of October, then you should not forget to to create one last Nexus export and send it to Nexus to synchronize all edits.

In summary, the following edit rules are applied to the Impact sessions and the Reportable Business Start Impact (RBSI) Date field on the client record:

| Edit functionality | Non-Administrators | Administrators |

| Delete Impact Session | Never | Never * |

| Edit Impact Session prior fiscal year | Never | Never |

| Edit Impact Session current fiscal year | Never | Can edit counselor, center and funding sources only |

| Edit/Delete prior FY RBSI Date on client record | Never | Never |

| Edit/Delete prior FQ in current FY RBSI Date on client record | Never | Yes |

| Edit/Delete current FQ in current FY RBSI Date on client record | Yes | Yes |

* Administrators can delete the RBSI date from the client record, assuming the RBSI date falls within the current fiscal year, and this will automatically delete the corresponding Impact session.

Employee Owned

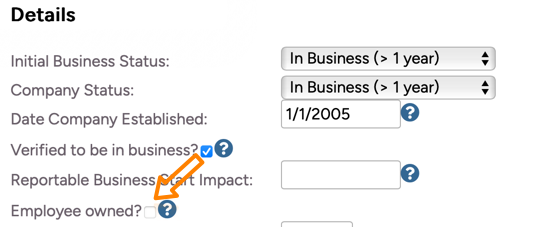

In December 2024, SBA introduced a new field in the XML schema that is not yet reflected on the OMB approved SBA 641 form. For any client that is verified to be in business, SBA wants to know whether the company is "Employee Owned."

Employee ownership is a term for any arrangement in which a company's employees own shares in their company or the right to the value of shares in their company. Employee ownership is a broad concept that can take many forms, ranging from simple grants of shares to highly structured plans. Congress created tax incentives to promote the creation of employee stock ownership plans (ESOPs), currently the most common form of employee ownership in the United States. Other forms of employee ownership include worker cooperatives, employee ownership trusts, direct employee ownership, stock options, stock grants, and synthetic equity (granting the right to the value of shares but not the shares themselves).

It is important to note that sole proprietors are not considered to be employee owned. In a sole proprietorship, business property, liability, and income are treated as the personal property of a single person. These businesses will have to first establish a partnership or incorporate to share ownership with employees.

Neoserra will present this new field once a business has been verified to be in business:

This is a Yes/No field. By default, all clients are not considered to be employee owned.

Want more? Browse our extensive list of Neoserra FAQs.